Menu

| Transact | > | Journal |

Mandatory Prerequisites

Prior to entering a General Ledger Journal Transaction, refer to the following Topics:

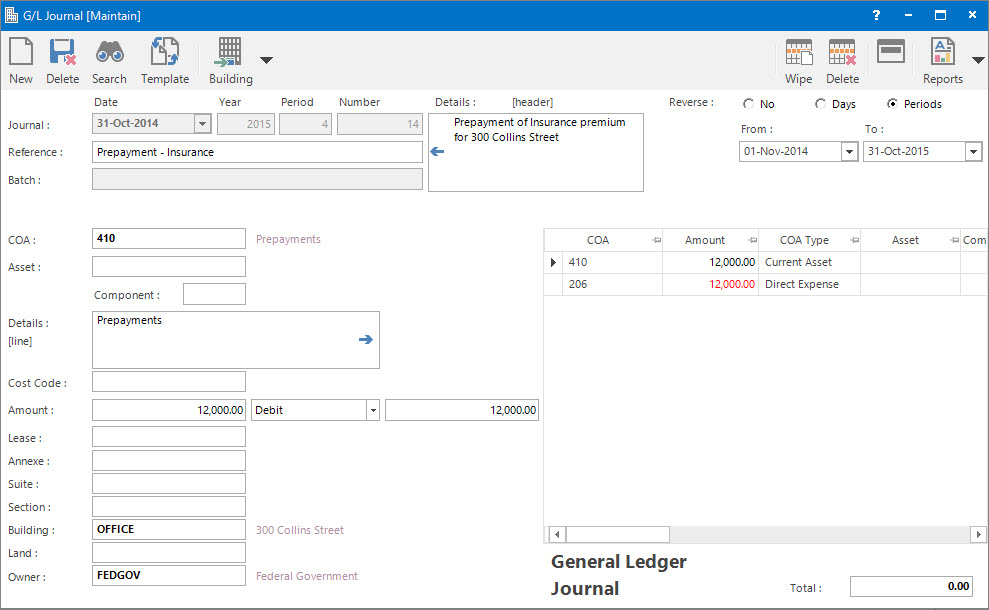

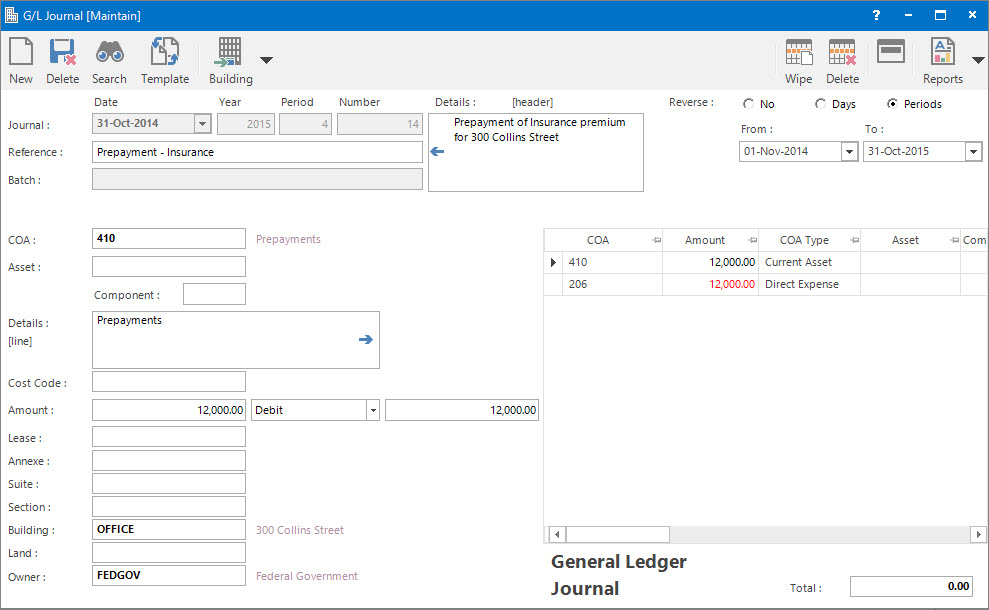

Screenshot and Field Descriptions

General Ledger Journals follow the Double Entry book-keeping rule of having a balanced set of entries.

On the Transaction Item fields the Black Debit entries must be balanced by Red Credit entries.

The net total must be zero.

Transaction Header fields (Top):

Transaction Date: this is the date of the transaction. Normally it must fall within the Accounting Period defined by the Year and Period.

Year: this is the Accounting Period Year.

Period: this is the Accounting Period.

The default values for Transaction Date, Year and Period come from the Accounting Period marked as Current.

Number: this is the Accounting Period Number. The combination of the Year, Period and Number constitutes the unique transaction Number.

Reference: this is a free format, optional reference entry field.

Batch: this is a read only field that displays the batch number / date of when the transaction was interfaced with another system.

Details (Header): this is a free format, optional detail associated with the whole transaction. Details for each transaction line can be entered in the Details (Line) field. The Copy Details button will move any text entered to the Details (Line) field.

Reverse: this is the options for creating reversal journals based on the journal being entered. The journal can be reversed over multiple accounting periods. Select from:

No: reversal journals will not be created.

Days: the reversal journals will be apportioned on the number of days in a period.

Periods: the reversal journals will be evenly apportioned on a period basis.

From: this is the date to create the reversal journals from.

To: this is the date to create the reversal journals up to.

Transaction Item fields (Bottom):

COA: this is the Chart of Account ID of a transaction Item.

Asset: if the transaction line is associated with an Asset, it can be optionally entered here. This will allow such transactions to be referenced in the Asset application.

Component: this is an optional Component sub classification of the Asset above.

Details (Line): this is a free format, optional detail associated with each transaction line. It will default to the value set up for the COA. Details for the whole of the transaction can be entered in the Details (Header) field. The Copy Details button will move any text entered to the Details (Header) field.

Cost Code: this is the cost centre that the amount relates to. This field can be set as optional, mandatory or not required on the COA set up screen.

Amount: this is the transaction line Amount.

Sign: this is the sign of the Amount. The default value of this field is automatic based on the COA used.

Annexe: this is the Annexe ID.

Suite: this is the Suite ID.

Section: this is the Section ID.

Building: this is the Building ID.

Land: this is the Land ID.

Owner: this is the Owner ID.

Transaction Items Table: this contains rows of the transaction items entered. New ones can be added. Existing ones can be deleted or changed by double clicking. Their content can be maintained in the fields on the left hand side. The items can be a mixture of debits and credits. Their combined total must be zero.

How Do I : Search For and Maintain Entities

These General Rules are described in the Fundamentals Manual: How Do I : Search For and Maintain Entities

How Do I : Add a new General Ledger Journal Transaction

There are several ways of adding new General Ledger Journals:

Transaction Header Fields (Top):

These relate to the whole of the transaction:

Transaction Item Fields (Bottom):

Repeat for each transaction line:

Final:

How Do I : Modify an existing General Ledger Journal Transaction

How Do I : Delete an existing General Ledger Journal

A General Ledger Journal can only be deleted if there are no other transactions associated with it and its Accounting Period is Open.

General Ledger Journal Transactions are associated with the following Topics: